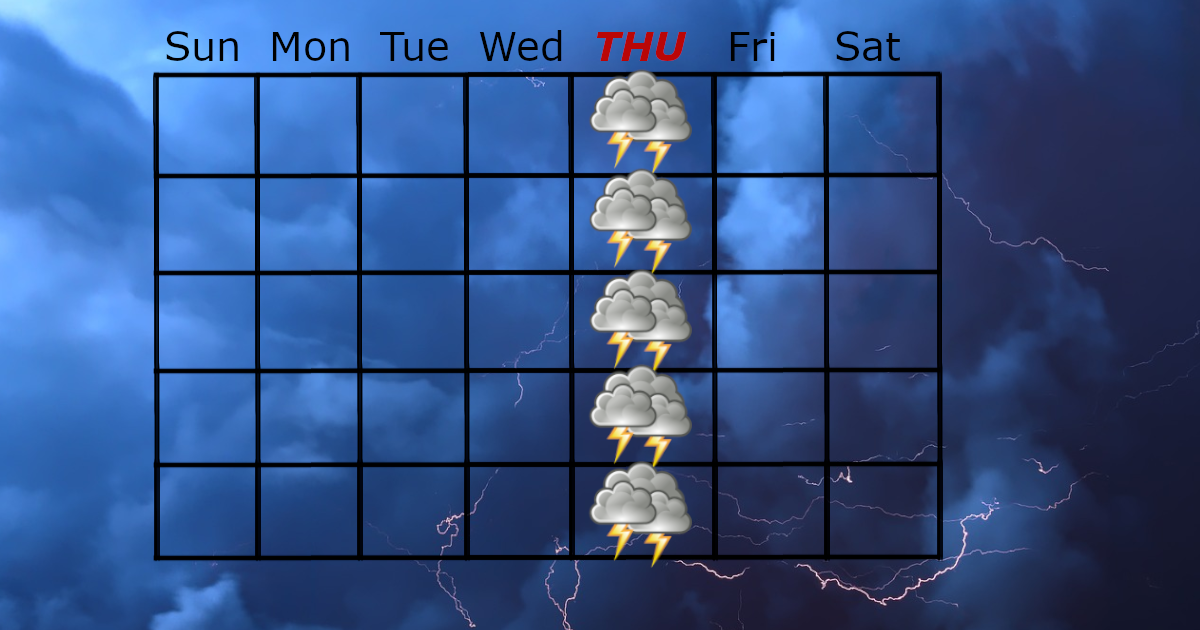

Thunderous Thursdays:

Strong Jobs Data Weighs on Stocks

High Frequency 180...

High unemployment claims sent stocks plunging during the pandemic. Now, ironically, low unemployment may be weighing on stock prices. A stronger than expected labor market, still remarkably resilient after a barrage of rate hikes from the Federal Reserve, may mean that though the battle against inflation is moving in the right direction, it may take longer to cool down price pressures until inflation readings fall to the Fed’s target of 2% annual inflation. Despite the Fed’s efforts to quell demand and slow economic activity, the labor market has yet to show significant cracks.

Thursday Data

Persistent employment data may be part of why Thursdays have been volatile over the past months. Government sources of weekly employment data, including the number of people filing initial and ongoing unemployment claims, are released on Thursday. The number of Americans filing unemployment claims for the first time, as well those filing continuing claims, can provide a gauge of the pace of hiring and layoffs. With the number of new claims for unemployment benefits recently dropping to an eight month low, the labor market is still tight despite a slowdown in the number of new jobs created. Although the Fed is widely seen as being done or nearly done with rate hikes, attention has now turned to how long they will leave rates in restrictive territory before lowering rates back down.

Higher Longer

Unemployment rates that are both historically low as well as lower than expected in the face of the Fed’s hiking campaign, may be weighing on stocks as it may signal the Fed will need to keep rates higher for longer in order for inflation to fall back down to their 2% target. Unemployment reports may be part of why stocks have fallen on 9 of the last 13 Thursdays. The average return on Thursdays from July through September was a loss of 0.3%. On Aug 24, stocks saw their biggest drop in the previous three weeks on the back of a lower than expected number of unemployment claims. Then, on Thursday Sept 21, stocks had their biggest one day drop in six months as unemployment claims dipped to an eight-month low. In the past three months, the only Thursdays that stocks saw gains occurred when either initial or continuing claims rose.

Recession No-Show

As indicated by the Fed Funds futures market, which reflects participants’ views on the path of interest rates, markets have been continually underestimating the number of times the Fed would make rate hikes. This may not be that surprising considering that most economists expected the US would have slipped into at least a mild recession by this point. Instead, the labor market has defied expectations, with initial unemployment claims hovering at pre-pandemic levels since 2022, remaining well below the 280,000 level that economists often cite as being associated with a material slowdown in job growth. Continuing claims have been on a downward trend since April of this year, moving in the opposite direction than might be expected during a period of restrictive monetary policy.

Delayed Cuts…

In addition to the weekly unemployment claims, monthly labor data continues to reveal a resilient workforce. A report released Tuesday Oct 3 showing the number of job openings breaking a three-month decline sent stock prices tumbling. Though the housing market along with manufacturing may have been hit the hardest so far by rate hikes, the overall labor market continues to remain tight. With jobs data consistently defying expectations, investors may be in an ongoing process of reassessing just how long the Fed will decide to keep rates elevated. Just as they have repeatedly expected fewer rate cuts than were actually delivered, markets’ views on when the Fed will bring rates back down may continue to be readjusted if strong labor data keeps signaling potentially longer-lasting inflation.

October 4, 2023

Markets Demystified is published the first and third Wednesdays of each month, and explores how stock market investing can relate to personal finance.

Thanks for reading!

Aesop Advisor LLC advertisements including newsletters and other publications are for informational purposes only. They do not attempt to predict future stock market moves and are not intended as individual investment advice. Aesop Advisor LLC newsletters and publications are not recommendations to buy, sell or hold any asset and are not intended as actionable investment advice or market timing. Equities references generally refer to the overall stock market, though if individual companies are mentioned, it is not a recommendation to buy, sell, or hold shares of the company. Unless otherwise indicated, terms including "stocks", the "stock market", and "market(s)" refer to Standard & Poor's 500 index. All investments involve risk and the past performance of a security or financial product does not guarantee future results or returns. While diversification may help spread risk, it does not assure a profit or protect against loss. There is always the potential of losing money when you invest in securities or other financial products. Publications and advertisements from Aesop Advisor LLC are not intended as investment, legal, or tax advice. Although gathered from sources believed to be reliable, Aesop Advisor LLC cannot guarantee the accuracy and completeness of data or information presented in publications and advertisements. This is an advertisement.