Gyrating Rates:

Flailing Fed Funds Futures

Transitory Story...

When post-pandemic inflation began heating up in the summer of 2021, the price pressures were initially viewed as temporary by economists and the monetary policy makers at the Federal Reserve. When supply chains did not mend as quickly as anticipated, and consumers were unleashed after two years of pandemic lockdowns, the Fed decided to take action by raising interest rates to cool down spending across the economy. Still expecting supply chains to heal, the Fed made a hike of a quarter percent in March 2022, and said they were not considering hikes above the 0.25% range.

Double 180

However, as prices continued rising at a relentless pace, the Fed went ahead with a half-percentage point hike, while saying again that they did not expect to make hikes above that rate. In the face of persistent fuming inflationary pressures from supply chains that proved to be still in tatters, complicated further by the start of war in Europe, the Fed made yet another about-face, hiking rates by 0.75% in June 2022. After four consecutive hikes of 0.75%, the Fed tamped on the brakes in December 2022, lowering the hike back down to 0.50%. When they made another reduction down to 0.25% at their next hike in February, markets seemed ready to declare victory over inflation, with Fed Funds futures markets expressing an expectation of just one more hike to come.

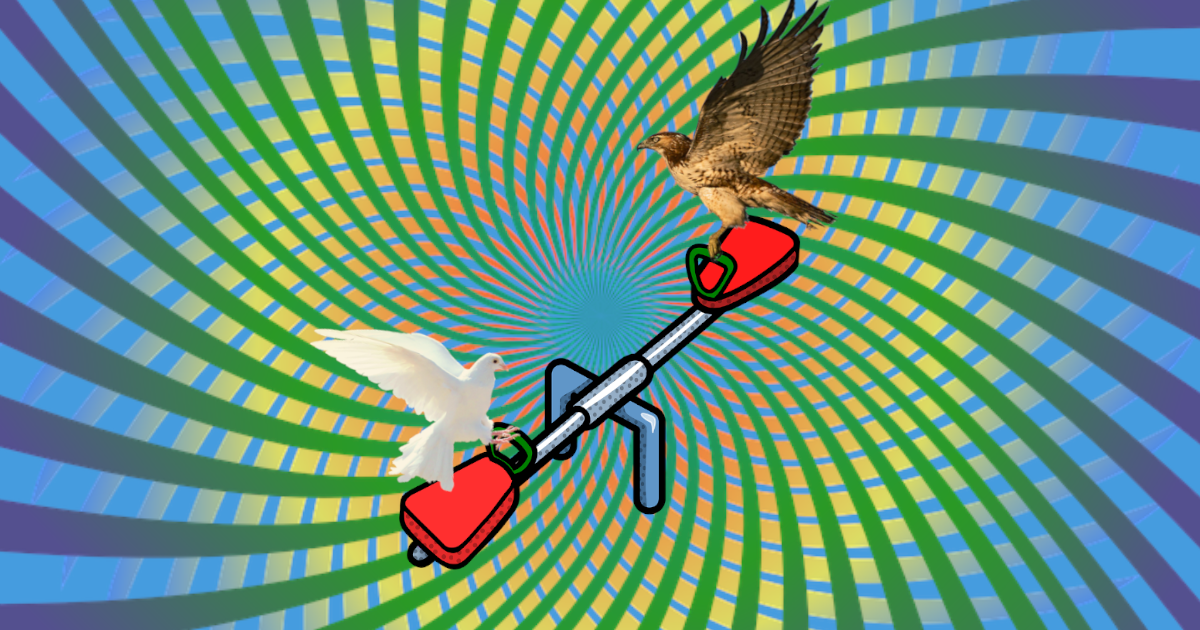

Hawks & Doves

Just two days after the Fed ratcheted down to 0.25%, a blowout monthly jobs report showed 517,000 jobs were created in January, over 300,000 more than economists expected. Markets reacted by swiftly changing the number of rate hikes expected from just one to two. Following the staggering jobs report, monthly readouts on inflation showed price pressures still lingering. Markets reacted by increasing the number of expected rate hikes from two to three. Following the aftermath of February’s hawkish data, dovishness returned in the wake of the March banking meltdown. After the stunning and sudden collapse of Signature and Silicon Valley Bank, some thought the banking turmoil would cause the Fed to pause their interest rate hiking cycle to avoid causing any further financial fallout. Up until the Fed’s next meeting in March, markets were pricing in just a 61% chance of a quarter-percentage hike and a 40% chance of no hike. However, on March 22, the Fed went ahead with an additional 0.25% hike.

Rates Gyrate

In the days following the Fed’s March hike, markets were pricing in just around a 50% chance of one more additional hike. As February’s strong economic numbers did not carry through to March, softening economic data caused markets to suspect the Fed had made a big enough dent in demand to finally hit the brakes on hikes, with markets reflecting a 60% expectation of a pause in hiking and just a 40% chance of a hike. In another shift, a solid job growth number in April sent expectations up for another 0.25% hike. Then, a report showing renewed progress towards reducing inflation caused another flip-flop, with markets once again lowering their expectations of another hike.

Economy Solid…

Throughout April, data showing the economy and labor market is still remarkably resilient in the face of a historic rate hiking cycle, market participants have firmed up their bets for a 0.25% hike on May 3. In the past few weeks, the implied odds of a hike have hovered around 90%. After more than a year of swift hikes, markets are firmly betting that May’s hike will be a final hike. Markets expect the Fed to pause to assess how the banking fallout will tighten credit conditions, likely doing some of their inflation-fighting work for them, and how much more time it may take for the hikes made so far to continue taking their full effect. If the Fed has indeed achieved what they have set out to do, then they have cooled spending enough to tame inflation, without tipping the economy into a severe or prolonged downturn. Economic data and inflation reports in the following months will reveal the outcome.

May 3, 2023

Dove: Policy position seen as more willing to enact expansionary policy such as lowering interest rates or using quantitative easing with a focus on lowering unemployment and growing GDP.

Fed Funds Futures: The CME Group, which operates a global derivatives exchange, describes its Fed Funds futures market as a “direct reflection of collective marketplace insight regarding the future course of the Federal Reserve’s monetary policy”.

Hawk: Policy position seen as more willing to enact restrictive monetary policy such as raising interest rates with a focus on controlling inflation or economic cycles.

Markets Demystified is published the first and third Wednesdays of each month, and explores how stock market investing can relate to personal finance.

Thanks for Reading!

Sincerely,

Jonathon Oden

Owner | Aesop Advisor LLC

Aesop Advisor LLC advertisements including newsletters and other publications are for informational purposes only. They do not attempt to predict future stock market moves and are not intended as individual investment advice. Aesop Advisor LLC newsletters and publications are not recommendations to buy, sell or hold any asset and are not intended as actionable investment advice or market timing. Equities references generally refer to the overall stock market, though if individual companies are mentioned, it is not a recommendation to buy, sell, or hold shares of the company. Unless otherwise indicated, terms including "stocks", the "stock market", and "market(s)" refer to Standard & Poor's 500 index. All investments involve risk and the past performance of a security or financial product does not guarantee future results or returns. While diversification may help spread risk, it does not assure a profit or protect against loss. There is always the potential of losing money when you invest in securities or other financial products. Publications and advertisements from Aesop Advisor LLC are not intended as investment, legal, or tax advice. Although gathered from sources believed to be reliable, Aesop Advisor LLC cannot guarantee the accuracy and completeness of data or information presented in publications and advertisements. This is an advertisement.