Inflation Persists:

Labor Market Unfazed

Victory Flag...

Markets seemed ready to declare victory over inflation after the last Federal Reserve meeting that concluded on Feb 1. At that meeting, voting members of the Fed decided to raise rates by 0.25%, lower than the previous hikes of 0.5%, which followed hikes of 0.75%. For the first time, Fed chair Jerome Powell said “the disinflationary process has started”. After the meeting, markets appeared to decide that the Fed was nearly through with rate hikes. Though the Fed made it clear “ongoing increases” of 0.25% each would be needed, markets did not appear to believe it. Fed fund futures, which express market participants’ views on upcoming Fed decisions, were pricing in just one more hike followed by an immediate pivot to rate cuts by the end of the year.

Early Celebration

With markets appearing to proclaim triumph over inflation by the Fed, marking an end to the most aggressive rate hiking cycle in decades, the stock market rose until a completely unexpected jobs report became the first storm to rain on the victory parade. On Friday February 3, two days after the Fed meeting, the monthly nonfarm payrolls report showed 517,000 jobs were created in January, over 300,000 more than economists were expecting. The report also showed that the unemployment rate fell to 3.4%, the lowest in over five decades. Markets reacted by swiftly changing the number of rate hikes expected from just one to two, while still reflecting expectations of the Fed to cut rates later in the year.

Stubborn Inflation

Following the stunning jobs number, the upcoming round of inflation readings came in higher than forecast. The consumer price index (CPI), released on Valentine’s day, showed that although prices on an annual basis slowed a tiny bit, prices rose 0.5% in January after gaining just 0.1% in December. After the report, financial markets raised their bets on the odds of a third rate hike, though market participants still saw the Fed cutting rates by the end of the year. The Feb 24 release of personal consumption expenditure (PCE), the inflation gauge most closely watched by the Fed came as a final blow to expectations of a Fed pause. PCE data showed prices increased on both a month-to-month and annual basis. Following the PCE release, futures markets firmed their expectations of at least three more rate hikes, while nearly erasing their bets of rate cuts by this year.

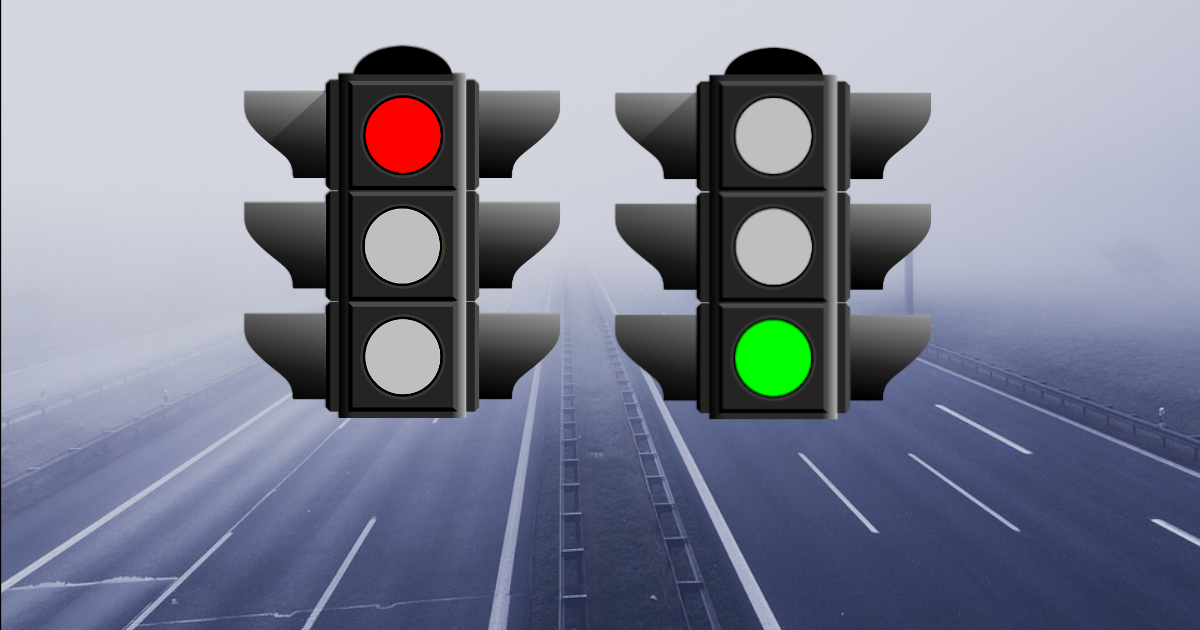

Going On Red…

Though the Fed has been rapidly hiking rates in an attempt to slow demand in their push against spending-fueled inflation, the labor market seems to be running the Fed’s red light, continuing to create jobs and support spending. Consumer spending, which makes up more than two-thirds of US economic activity, rose by the most in nearly two years. Other data showed savings rates increased, suggesting many consumers were able to maintain their spending without depleting savings. A strong labor market supporting consumer spending will make it difficult for the Fed to tamp down on demand. For stocks, good news may remain bad news for at least the near-term. Though upbeat economic news may signal the economy can absorb the Fed’s rate hikes without tipping into a steep recession, it may push the Fed to remain restrictive for longer. One of the challenges for the Fed is that the exact time it takes for the effects of hikes to make their full impact is uncertain. With estimates ranging from between six months and two years, the Fed has to walk a fine line of hiking enough to bring inflation back down to its target of 2%, without over-hiking and tipping the economy into unnecessary contraction.

March 1, 2023

Markets Demystified is published the first and third Wednesdays of each month, and explores how stock market investing can relate to personal finance.

Thanks for Reading!

Sincerely,

Jonathon Oden

Owner | Aesop Advisor LLC

Aesop Advisor LLC advertisements including newsletters and other publications are for informational purposes only. They do not attempt to predict future stock market moves and are not intended as individual investment advice. Aesop Advisor LLC newsletters and publications are not recommendations to buy, sell or hold any asset and are not intended as actionable investment advice or market timing. Equities references generally refer to the overall stock market, though if individual companies are mentioned, it is not a recommendation to buy, sell, or hold shares of the company. Unless otherwise indicated, terms including "stocks", the "stock market", and "market(s)" refer to Standard & Poor's 500 index. All investments involve risk and the past performance of a security or financial product does not guarantee future results or returns. While diversification may help spread risk, it does not assure a profit or protect against loss. There is always the potential of losing money when you invest in securities or other financial products. Publications and advertisements from Aesop Advisor LLC are not intended as investment, legal, or tax advice. Although gathered from sources believed to be reliable, Aesop Advisor LLC cannot guarantee the accuracy and completeness of data or information presented in publications and advertisements. This is an advertisement.